By May 8, 2024

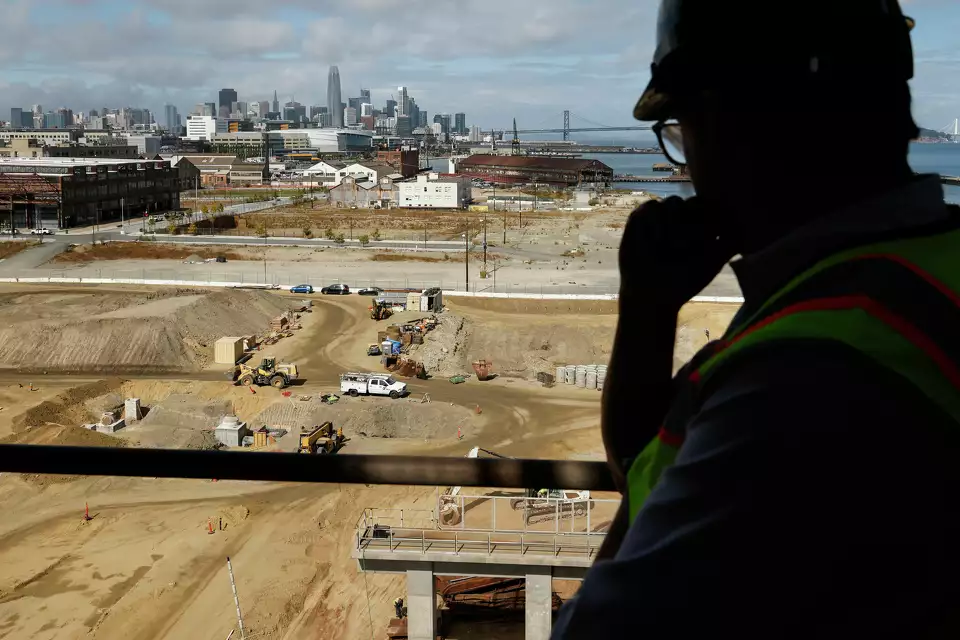

A regional housing bond could open the pipeline to the construction of thousands of new homes throughout the Bay Area. Jessica Christian/The Chronicle

A regional housing bond could open the pipeline to the construction of thousands of new homes throughout the Bay Area. Jessica Christian/The Chronicle

The $20 billion housing bond likely headed to Bay Area ballots in November could create an unprecedented cascade of affordable construction projects that would “unlock” a pipeline of nearly 41,000 units across the nine-county region.

A new report from the affordable housing financing group Enterprise Community Partners and the Bay Area Housing Financing Authority, known as BAHFA, found that there are 443 projects totaling 40,896 units that are somewhere in the process of being approved or financed.

Santa Clara County has the most below-market-rate units teed up for development, with 86 projects totaling 10,367 homes; followed by Alameda County, with 115 developments totaling 10,086 units. San Francisco has 86 pending projects with 8,448 units.

While many California cities are well known for blocking or delaying development, a series of recent state laws, including Senate Bill 35 and its successor, SB423, have allowed affordable projects to win quick approval by bypassing the environmental review process and lengthy public hearings that typically bog down housing production.

But while some projects are breezing through the planning process, many of these projects have been stalled for years as their developers beat the bushes for financing, often applying for multiple rounds of funding through tax credits, affordable housing tax-exempt bonds and state and local money.

The result: There are hundreds of projects that are ready to go as soon as there is money to build. That is where the $20 billion comes in. “The astounding number of projects that are waiting in the wings is a testimony to the amount of the work we are seeing on the local and state levels,” said Justine Marcus, policy director for Enterprise Community Partners Northern California. “But they can’t move forward without the resources to do so.”

The report comes as the board of BAHFA, a quasi public financing authority that was created in 2020, is scheduled to vote on June 26 on an unprecedented $20 billion bond — the number that was recommended by the executive board of the Association of Bay Area Governments, or ABAG.

The $20 billion bond, which will require a two thirds majority to pass, could help create or preserve 72,000 new homes, with every dollar in bond money leveraged with three or four dollars in funding through tax credits and other state and federal sources. It would be divided into sections with 52% of the fund allocated for production, 15% for housing preservation, 5% for tenant protections and 28% for flexible housing uses, according to the report.

The bond would be funded by property taxes, with an estimated tax of $19 per $100,000 of assessed value — about $190 per year for a home assessed at $1 million. The amount of money each city receives from the bond would be based on how much that jurisdiction pays in taxes: San Francisco would get about $2.4 billion to invest, while Sonoma County would receive about $806 million and San Mateo County would get $1.05 billion.

The new report detailing the number of housing projects that the bond money would bring to life could help win over skeptical voters, according to Marcus, who said the report represents “a call to action pointing to the specific opportunities we have.” “To see, concretely, the projects across all nine counties that would be some of the first in line adds a resonance to the data,” she said. BAHFA executive director Kate Hartley said the report shows “how quickly we can get out of the gate if the bond passes.” “There are thousands of units that are ready to go that have already received public approvals — we are not starting from scratch,” Hartley said. “There are developments that have been entitled, have money from local governments, they have been through the planning process. We can have an immediate impact.”

While getting a two-thirds majority vote is never easy, Hartley said the need for subsidies to finance affordable housing is something that polls well among Bay Area voters.

“The lack of affordable housing really impacts everybody … whether you are a small business owner and can’t hire staff, or you’re dealing with homelessness or your adult kids have to move away because they can’t afford to own a home,” Hartley said.

Used with permission by the San Francisco Chronicle.

Read article at the SF Chronicle and subscribe to the SF Chronicle.