Free Income Tax Assistance

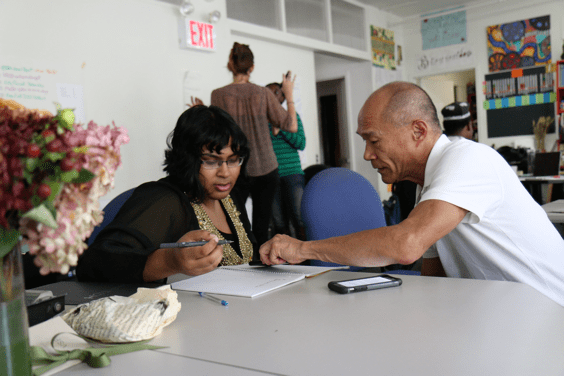

Maximizing a tax refund can put vital money back in people’s pockets. We offer free Volunteer Income Tax Assistance (VITA) where caring, trained volunteers guide Marin residents through matters such as reporting on public benefits and claiming the Child Tax Credit and the Earned Income Tax Credit (EITC), so they can claim tax benefits for which they’re eligible and understand their choices for the next year. Tax assistance is part of the integrated services that help to put long-term financial security within reach.

TAX PREPARATION LOCATION & HOURS:

Community Action Marin

7665 Redwood Blvd

Novato, CA 94945

Dates: February 6 – April 10, 2026

Hours: Fridays, 9:00am – 3:00pm

Any household with an income of $69,000 or below and a social security number or ITIN is eligible to have their California and federal income taxes prepared for free.

To have your 2025 taxes completed, here is a list of those items you will need:

- A valid ID and Social Security Card or ITIN, W2s, 1099s, and all other tax notices (For dependents, only Social Security Card or ITIN needed)

- Your bank account and routing numbers for direct deposit of your refund

- If you are self-employed or are paid in cash, you must have all expenses and income received categorized and totaled

In addition, we prepare simple returns only. This means no carryover losses, rental income, married filing single, Air BNB, depreciation, crypto currency or bitcoin transactions, or lump sum distributions. IRS certified tax preparers will contact you to go over your return and answer any questions you may have. Please note that returns are processed same day.

If you have additional questions about our Income Tax program, please look at the Frequently Asked Questions section below, download our flyer, or call 415.526.7500. You may also visit the United Way’s Free Tax Help page on their website for a complete list of free tax preparation locations.

Frequently Asked Questions

Any household with income of $67,000 or below and a social security number or ITIN is eligible to have their 2024 California and Federal Income taxes prepared for free through our Volunteer Income Tax Assistance (VITA) website, Get Your Refund.

To have your taxes completed, you must have:

- A valid ID and Social Security Card or ITIN, W2’s, 1099’s, and all other tax notices (For dependents, only Social Security Card or ITIN needed)

- Your bank account and routing numbers for direct deposit of your refund

- People who are self-employed or are paid in cash must have all expenses and income received categorized and totaled as well

Please note that returns are processed same day.

If you require Tax Services on Saturday, please reach out to the Canal Alliance at 415.454.2640 and someone there should be able to assist you.

Transform your Finances

Our financial assistance helps people transform their overall finances, so they can rise beyond subsistence-living and thrive, working towards a goal of financial prosperity.